Mississippi Debt Relief

Reduce Your Credit Card Debt By Up To Half

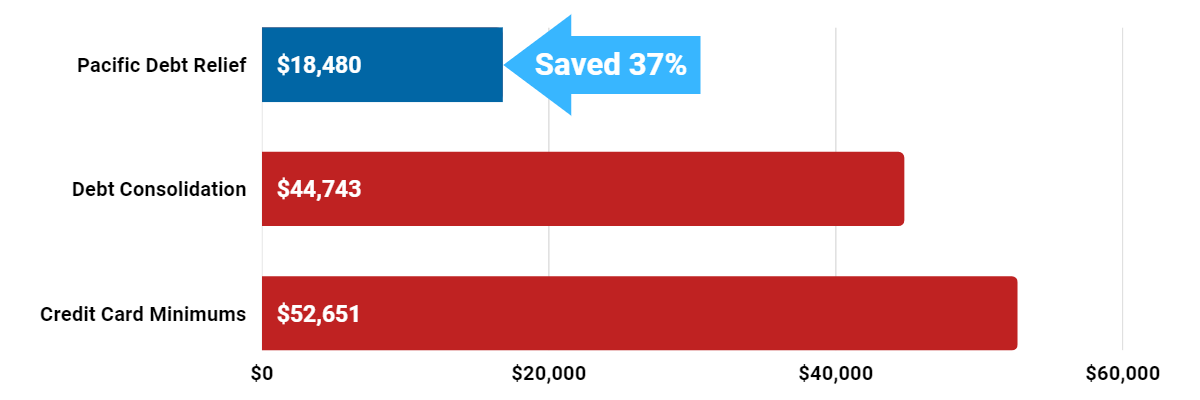

Pacific Debt Relief offers the only solution that significantly reduces your debt to less than you currently owe. That means you get debt-free in a fraction of the time it would take with other options.

Save thousands by lowering your debt balance and wiping away years of future interest and payments. Call today for a FREE consultation!

Mississippi Debt Relief Reviews

What are Mississippi Debt Relief Programs?

Mississippi debt relief is debt reduction through settlement or consolidation. The overall goal for debt relief is to reduce the amount you owe your creditors. Debt settlement is one option and is our area of expertise.

Pacific Debt Relief specializes in debt settlement services. In this program, we actively negotiate with your creditors to reduce your debt for less than you owe and in some cases, we may be able to lower interest rates. We have a good relationship with many companies and know what they are willing to settle for in many cases. Most unsecured debts qualify for the Pacific Debt program, including credit card debts.

Contact us today and get a FREE consultation with no obligation.

Pacific Debt works directly with creditors while guiding you throughout the entire process. Your assigned manager with keep you appraised of all negotiations and you can always call them with questions.

Our best-rated settlement programs are available for Mississippians. Call our certified specialists who will explain all your relief options. Our free analysis will help you make an informed decision about your unsecured debt and your financial health.

Is This Mississippi Debt Relief Program Legit?

Pacific Debt has helped countless Mississippians reduce their outstanding full amount and live a better future. Since 2002, we've settled over $300 million in credit card debt for our clients.

Anyone searching for a debt consolidation plan or for debt management may benefit from a free conversation with our debt specialists.

We may be able to help lower your monthly payments. If you are looking for consolidation loans but have bad credit, our settlement program might be perfect for you! If you are considering bankruptcy, you definitely need to speak with one of our debt experts before you file.

We are experts at debt negotiation so call for your financial situation. Your first step is a FREE phone call with one of our specialists who can lay out all your options, so you understand your position and what steps need to be taken.

We do not require a debt consolidation loan or personal loan. Instead, we negotiate reduced interest rates, offer helpful resources, and a lower monthly payment with no upfront fees.

Get Free Consultation from our award-winning professional debt negotiators

During Pacific Debt's program, you deposit an agreed single monthly payment amount in your own escrow bank account. As you build up sufficient funds, we pay your settled accounts.

What to Expect in Debt Settlement

- Affordable monthly payments into a secured saving account based on your budget

- Resolve your situation in 2-4 years

- No upfront fees with low monthly fees that vary from 15-25% of the total enrolled amount and state of registration

- Personal attention from our Client Success Team

- Repayment plan and possibly lower interest rates.

- Excellent Customer Service & Support

- We negotiate a decreased lump sum payment and lower interest rates

Who Qualifies for Debt Relief?

In order to qualify for our debt program, you must meet the following:

- Outstanding debt amount of at least $10,000 in unsecured debts (credit card debt, payday loans, personal loans, medical bills, collections and repossessions, and some student loans).

- Difficulty making minimum payments

- Live in Alabama, Alaska, Arizona, Arkansas, California, Colorado, District of Columbia, Florida, Idaho, Indiana, Kentucky, Louisiana, Massachusetts, Maryland, Michigan, Minnesota, Missouri, Mississippi, Montana, North Carolina, Nebraska, New Mexico, New York, Oklahoma, Pennsylvania, South Dakota, Texas, Utah, Virginia, or Wisconsin

* The information included on this site is for educational purposes only. Since not all states are included in our program, not all clients can enroll in our company. We can connect you with a Trusted Partner or help you find a provider who offers services in your state of residence.

There are some consequences for your program which can include temporary damage to credit reports. The most serious are potential tax consequences. The IRS considers forgiven debt amounts income, and you may have an unexpected tax bill. Before pursuing a settlement, discuss potential tax consequences with a tax professional in order to shield yourself from too many consequences.

We are also not debt settlement lawyers and are not suggesting that we have an attorney-client relationship.

Pacific Debt Accreditation

Pacific Debt Relief is proud to be accredited by the following organizations.

- The International Association of Professional Debt Arbitrators

- The Consumer Debt Relief Initiative

- Better Business Bureau

Always check for accreditation as many debt settlement companies can be scams. Accreditation means that we have met or exceeded standards and training for our work. You can get more information about accreditation and if the company is accredited by contacting each company.

Reviews of our Mississippi Debt Relief Program

- Accredited by Better Business Bureau since 2010 with BBB A+ rating(4.79 rating and 144 reviews)

- US News and World Reports and Bankrate.com ranked Pacific Debt as one of “The Best Debt Settlement Companies of 2020”

- 4.8 star rating by BestCompany.com (over 2341 client reviews)

- 4.8 star rating by TrustPilot based (over 718 verified consumer reviews)

- ConsumerAffairs.com Accredited (over 538 verified reviews with an average rating of 4.6 stars)

- A Top 10 Rated Company by TopTenReviews.com , ConsumersAdvocate.com and Top10debtconsolidation.com

- 4.6 star rating by Google (83 client reviews)

- 100% rating by SuperMoney (9 client reviews)

Follow the links to read actual reviews by verified clients. We are very proud of our ratin and reviews! Pacific Debt has helped thousands of people reduce their debt. Since 2002, we've settled over $300 million in debt for our clients. Contact us today to see how we can help.

Testimonials from Real Clients

Click here to get your FREE Consultation & Savings Estimate, or call us at 800-909-9893.

We can help you and your family with relief from debt in the state of Mississippi, or even nationwide.

Mississippi Better Business Bureau

Pacific Debt Relief is an A+ rated business with the BBB. We have been accredited since 2010. We have received 4.87 out of five stars based on 40 customer reviews with the BBB.

The State of Mississippi

Mississippi has an old and storied history. It offers coastal living, rolling hills and the roiling waters of the Mississippi River. Mississippi is ranked #31 for population and #33 for population density.

As of 2018, almost 3 million people called Mississippi home. Jackson is the largest city in Mississippi.

Income

The median state income is $50,860. As of 2018, the minimum wage is $8.25 per hour. Unfortunately, 21.3% of Mississippi children under 18 live in poverty. For residents overall, 14.7% of all people in Mississippi live under the poverty level or are low income families.

- Median state income: $41,754

- Minimum wage: $7.25/hour

- Children in poverty: 30%

- People in poverty: 20.8%

Is Mississippi a Community Property State?

Mississippi is not a community property state. Therefore your assets are not seen as equally owned by you and your spouse.

Currently, only Louisiana, Arizona, California, Texas, Washington, Idaho, Nevada, New Mexico, and Wisconsin are community property states.

Homeowners

More than half (64.1%) of Mississippians hold a mortgage. The median home price in Mississippi topped $200,000 (2018) for the first time. In general, housing prices are fairly low. Of course, that median price depends on the location with some areas being much higher.

- Homeowner rate: 71%

- Median home price: $122,500

Employment

Mississippi has a current unemployment rate of 4.5%. However, the underemployment rate is 10.9%. Underemployment is the percentage of civilian workers who are unemployed, employed part-time, or are not seeking employment. Employment and low minimum wage can create financial hardship.

If this is you, we can help. Pacific Debt offers solutions tailored to your unique situation and budget. Our certified counselors help you work up a budget and explain your options.

- Unemployment: 4.5% (2018)

- Underemployment: 10.9% (2017)

Mississippi Debt

Mississippians carry a lot of debt. The average credit card debt is $4,594 (2018). The average student loan debt is $26,177. All that debt added to the cost of homes combined with the low median income and minimum wage makes it very easy for Mississippians to get into debt.

- Avg credit card debt: $4,594 (2018)

- Avg mortgage debt: $102,301 (2017)

- Avg student loan debt: $26,177 (2017)

Mississippi Statute of Limitations

Mississippi's statute of limitations lays out time periods that debt collectors can take action against a delinquent debt. These statutes of limitations begin on the date that your debt goes delinquent. Knowing the age of your debt is very important as you may not be required to pay "aged out" debt.

For debts taken out in Mississippi, the following are the statutes of limitations for different types of debt.

- Oral agreements: 3 years

- Written contracts: 3 years

- Promissory notes: 3 years

- Credit cards and other revolving loans: 3 years

Debt Collection Laws in Mississippi

Mississippians are protected against unscrupulous debt collectors by federal law. The federal Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from harassing debt collection practices. These can include threats, contacting family or employers, or calling after 9 p.m. If you are a victim of any of these actions, speak with a law firm.

Pacific Debt, Inc

If you have more debt than you can pay off, Pacific Debt can help you consolidate your debt and learn to live debt free. We are a nationally top-ranked debt settlement company and have helped countless Mississippi residents with our national program.

Since 2002, we've settled over $200 million in debt for thousands of clients. We are a nationally top-ranked debt relief company located in San Diego.

We will help you work through our proven and comprehensive program. Your certified counselor will review all your options. If a settlement is right for you, we move forward with our debt consolidation program and work to save you money.

Pacific Debt can help with most unsecured debts like credit cards, personal loans, medical bills, and repossessions. We also deal with debt collection companies.

It is not an easy process, and it won't happen overnight, but you can do it. Pacific Debt will be there every step of the way to help.

Call us and ask our award-winning debt specialists about our settlement program and how it works. Remember we offer a no-obligation consultation.

Other Mississippi Relief Programs

We want you to understand your options including debt consolidation, credit counseling, and bankruptcy.

Read all program materials before enrolling in any debt relief program.

Mississippi Debt Consolidation

This rolls all debt into a debt consolidation loan, often a home equity loan or personal loan and then focuses on paying off the loan. Having a good credit history is a necessity for debt consolidation. You may get debt consolidation through a zero interest credit card balance transfer.

Click here to learn more about debt consolidation and debt consolidation loans.

Credit Counseling Agency

In credit counseling, a credit counselor helps you learn money management including developing a budget, helping you understand your credit scores, and set up a debt management plan.

Look for a nonprofit credit counseling agency. Credit counseling may be best for someone just getting into debt.

Click here to learn more about Credit Counseling.

Mississippi Bankruptcy

Bankruptcy is a last resort option. This legal action wipes out most of your owed debt including credit cards, severely damages your credit for up to ten years, and bankruptcy code is expensive and time-consuming.

Click here to learn more about bankruptcy and always contact Mississippi attorneys for assistance before you file bankruptcy paperwork.

Contact Pacific Debt for a free initial consultation

Pacific Debt Provides Debt Services to Mississippi Cities

Adams

Benton

Chickasaw

Clay

De Soto

Greene

Hinds

Itawamba

Jones

Lauderdale

Leflore

Marion

Neshoba

Panola

Pontotoc

Scott

Stone

Tippah

Walthall

Webster

Yazoo

Alcorn

Bolivar

Choctaw

Coahoma

Forrest

Grenada

Holmes

Jasper

Kemper

Lawrence

Lincoln

Marshall

Newton

Pearl River

Prentiss

Sharkey

Sunflower

Tishomingo

Warren

Wilkinson

Amite

Calhoun

Claiborne

Copiah

Franklin

Hancock

Humphreys

Jefferson

Lafayette

Leake

Lowndes

Monroe

Noxubee

Perry

Quitman

Simpson

Tallahatchie

Tunica

Washington

Winston

Attala

Carroll

Clarke

Covington

George

Harrison

Issaquena

Jefferson Davis

Lamar

Lee

Madison

Montgomery

Oktibbeha

Pike

Rankin

Smith

Tate

Union

Wayne

Yalobusha

Disclaimer: In some states, PDR may not be able to offer our services directly due to state regulations related to debt settlement. In those instances, PDR will refer you to a reputable debt relief provider or attorney firm for assistance with your debt. We are not lawyers and are not giving legal advice. Before filing bankruptcy, talk to a lawyer in your state. The information included on this site is for educational purposes only.

Do Not Sell My Personal Information

Do Not Sell My Personal Information